What is Financial Health Index® (FHI)?

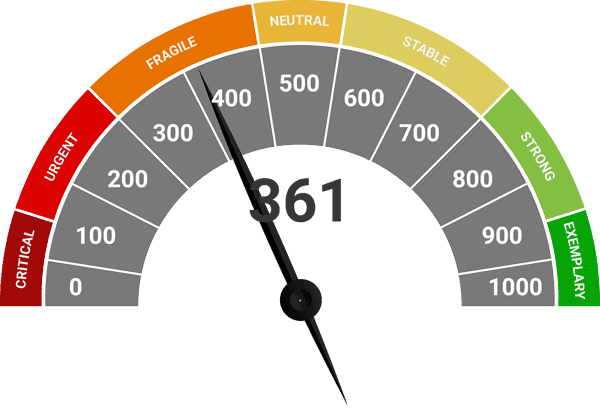

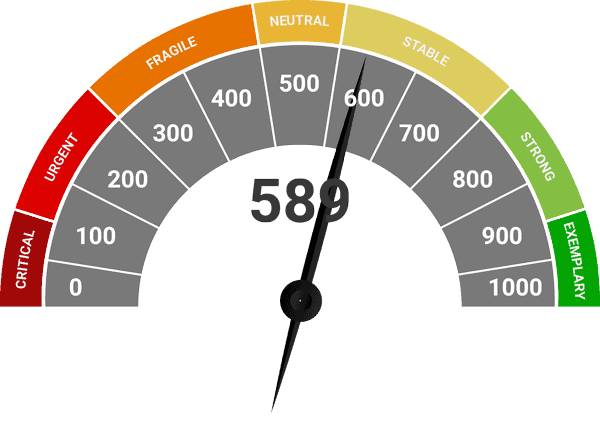

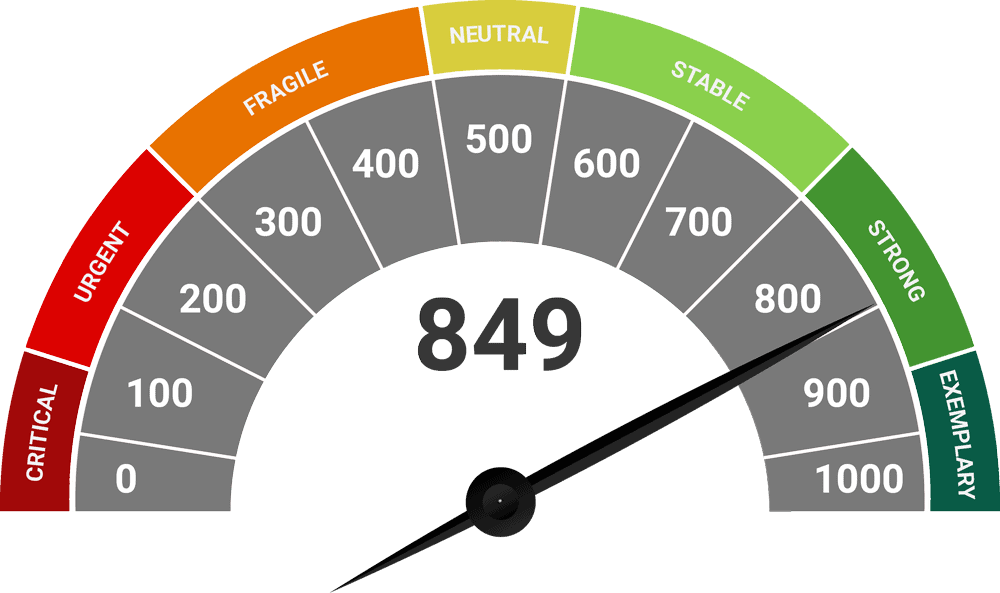

Financial Health Index® (also known as FHI) is a proprietary financial diagnostic service providing consumers a dynamic, numerical measurement of their “financial health and performance” in a standardized scoring system or index combining a variety of financial metrics to an accumulative score. These combined metrics are not based on responses or values that are subjective in nature (i.e., “How are you feeling about your finances today?”), but rather are objective, verifiable numbers, values or responses which are processed collectively in a series of progressive logical calculations. The calculated results are then expressed on a scale of whole numbers up to a maximum of 1000. The purpose of the index is to provide a diagnosis of a consumer’s financial health in the context of common sense principles of personal finance with a predilection for a debt‐free lifestyle trending toward financial independence in a predetermined order and sequence. Additionally, this index may be useful for third parties who are required to know a particular consumer’s financial condition for commercial purposes.

Financial Health Index®

Financial Standards We Measure

Impact of Elements

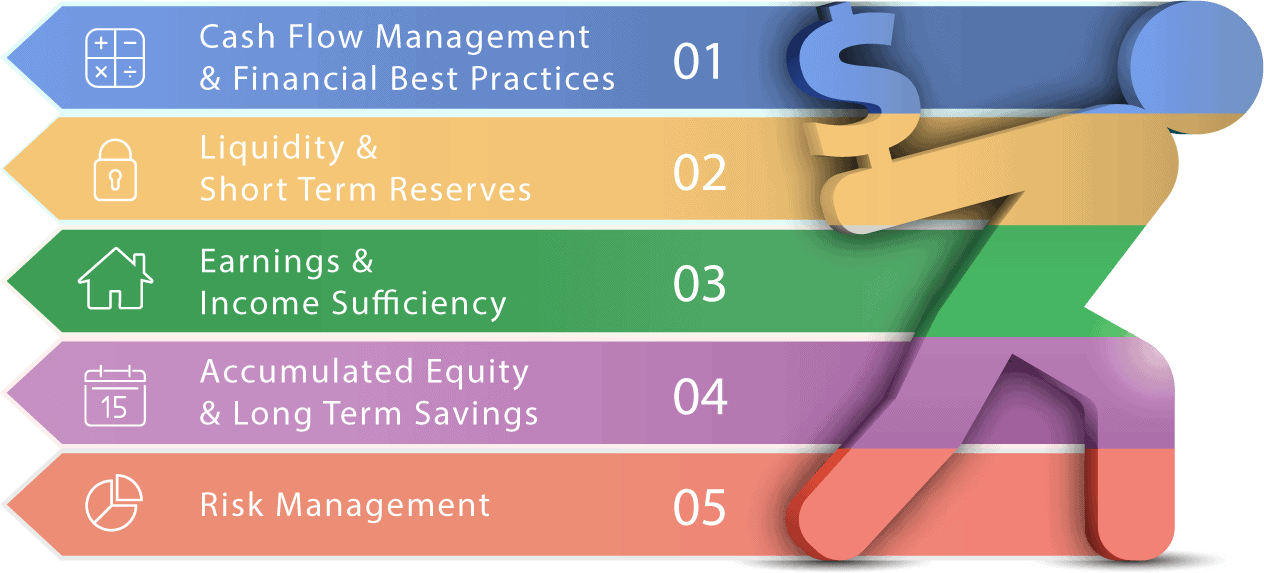

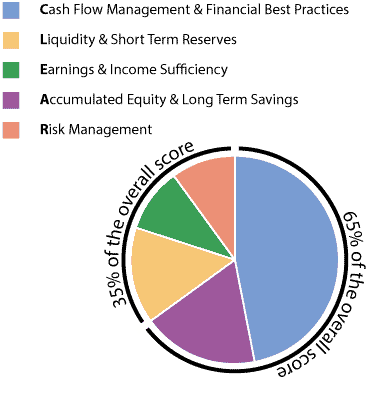

Three of th e five components (Earnings & Income Sufficiency, Liquidity & Short Term Reserves, and Risk Management) are fixed weighted components (10%, 15%, and 10% respectively) collectively valued at 35% of the overall score. The remaining two components–Cash Flow Management & Financial Best Practices–(CFM) and Accumulated Equity & Long Term Savings (LTS) are inversely related in their respective weightings up to a combined weight of 65% of the overall score and at the component level are variably weighted based on the age of the household’s primary income earner.

e five components (Earnings & Income Sufficiency, Liquidity & Short Term Reserves, and Risk Management) are fixed weighted components (10%, 15%, and 10% respectively) collectively valued at 35% of the overall score. The remaining two components–Cash Flow Management & Financial Best Practices–(CFM) and Accumulated Equity & Long Term Savings (LTS) are inversely related in their respective weightings up to a combined weight of 65% of the overall score and at the component level are variably weighted based on the age of the household’s primary income earner.

The CFM component is the predominant weight across all age groups because it is the principal characteristic or standard in assessing anyone’s financial health. All other FHI score components’ success is dependent on how cash flow is currently managed. Hindrances to cash flow (debt service, exceeding nominal budget guidelines, inability to save, poor financial practices) all have a debilitating impact on the CFM component’s score and consequently to all other components as well. As a person’s cash flow is properly managed, the CFM component score improves, bolstering the score of the other components accordingly.

To accurately measure the user’s overall financial health, the FHI’s components are dependent on various essential personal financial data points or factors‐such as:

- household income,

- size of household and number of dependents

- the cost of living index based on location

- age of household’s primary earner

- debt to income ratio

- debt to equity ratio

- income to equity ratio

- long term savings to equity ratio

- quantification of financial risks and exposures

- presence of proper risk transference through insurance

- presence of financial disciplines and financial best practices

- consumption lifestyle

- short term liquidity/cash reserves

- household consumer debt and debt service

- plus, many other essential metrics.