Are You in A Financial Crisis?

Living Pay Check to Pay Check

Your next payday never seems to come fast enough, and there is never any money left over.

Late Bills

Tired of paying late fees and getting disconnect notices.

Family Stress

Do many arguments revolve around financial issues?

“Success is the sum of small efforts, repeated day in and day out.” –Robert Collier

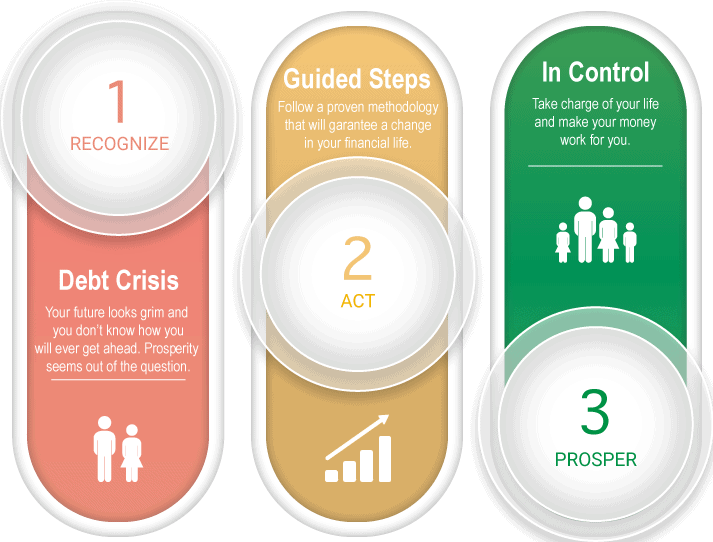

Where to Begin?

The source of many of lives problems begin with unhealthy financial practices. Once the problem becomes overtly prevalent and action is taken turn things around, it can seem as an overwhelming task. It can be hard for an individual or family to know where to begin to get ahead financially. Taking the wrong steps leads to frustration and loss of motivation.

The First Steps

We understand the issues that come with these kind of situations and have developed a methodology for recovering from a financial crisis. We start by developing a cash flow plan that puts the client’s short and long-term interests first. How a creditor gets paid is then subject to that plan. We will also consider options such as restructuring high interest debt, refinancing and/or consolidating debt when possible to get on the road to recovery. We then share tools and tips to communicate with creditors on the outworking of that plan to instill confidence and reduce the emotional strain caused by the crisis. Once a few disciplines and techniques are put into practice it becomes easy to see progress and understand how tackling a huge financial mountain is possible.

Take Control